XRP Price Prediction: 2025 to 2040 Forecasts and Key Catalysts

#XRP

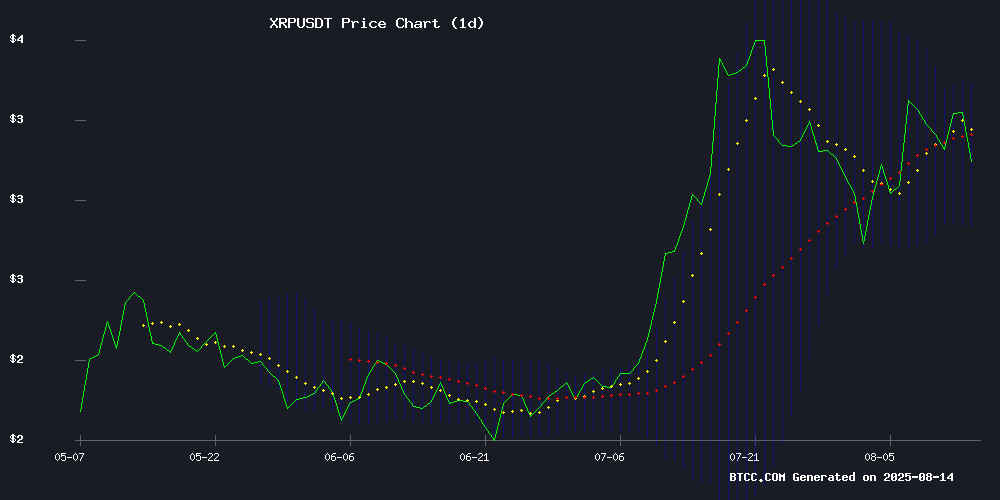

- Technical Strength: XRP holds above 20-day MA and tests Bollinger upper band, signaling bullish momentum.

- Regulatory Tailwinds: SEC case resolution and pro-crypto regulation shift reduce systemic risks.

- Adoption Catalysts: XRPL upgrades and Ripple's global expansion drive utility demand.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Key Breakouts

XRP is currently trading at, above its 20-day moving average (3.1200), signaling bullish momentum. The MACD histogram (-0.0402) suggests short-term consolidation, but the price holding above the middle Bollinger Band (3.1200) and testing the upper band (3.3990) indicates potential upside.says BTCC analyst Ava.

XRP Market Sentiment: Regulatory Wins and Upgrades Fuel Optimism

Ripple's CTO advocating for permissionless blockchains, combined with the XRPL upgrade and SEC case resolution, has bolstered bullish sentiment. News headlines highlight targets of(near-term) and(2025).notes Ava. Heavy volume at $3.33 suggests strong buyer interest.

Factors Influencing XRP’s Price

Ripple CTO Advocates for Public, Permissionless Blockchains Like XRPL

Ripple's Chief Technology Officer, David Schwartz, has underscored the enduring relevance of public, permissionless blockchains such as XRPL in shaping the future of programmable finance. In a recent statement, Schwartz highlighted XRPL's battle-tested infrastructure and institutional adoption as key differentiators in an increasingly fragmented blockchain landscape.

Permissionless networks like XRPL offer critical advantages over validator-restricted chains, particularly in global financial connectivity. The XRP Ledger's decade-long evolution has positioned it as viable infrastructure for mainstream financial systems, combining openness with real-world utility.

Schwartz emphasized the difficulty of building both blockchain technology and its surrounding ecosystem. XRPL's success stems from its original design purpose: enabling seamless transactions at scale. The ledger's growing traction demonstrates how public networks can achieve enterprise-grade adoption without sacrificing decentralization.

XRPL Gets Major Upgrade: Ripple’s 8-Transaction Batch Feature Clears Testing

Ripple has successfully completed performance tests for the XRP Ledger's new Batch Transactions feature, enabling users to bundle up to eight transactions into a single package. This enhancement significantly boosts processing power for complex operations while maintaining the ledger's five-second consensus time, even under heavy load.

The feature is particularly useful for atomic swaps, conditional token mintage, and setting transaction fees simultaneously. Ripple's implementation ensures all transactions within a batch must succeed as a group, eliminating partial outcomes that could lead to errors.

XRPL's throughput sees a notable increase with this update, as Batch Transactions act as a lever to push performance beyond baseline levels. The network's signature speed remains uncompromised, reinforcing its position as a high-performance blockchain solution.

XRP Price Prediction 2025: $7.14 in Sight as Ripple Expands Globally

XRP has surged to $3.27, marking a 9.42% weekly gain amid heightened trading volume of $9.47 billion. Analysts highlight $3.33 as a critical resistance level, with a breakout potentially propelling the token toward $4.44 and eventually $5.85.

Ripple's global expansion and growing central bank interest bolster long-term prospects. DigitalCoinPrice projects XRP could surpass $7.14 by 2025, contingent on breaching its all-time high of $3.84. The bullish momentum is reinforced by a stable RSI and broader cryptocurrency market recovery.

XRP Price Prediction: Analysts Target $3.46-$3.48 Breakout Amid Symmetrical Triangle Pattern

XRP shows bullish momentum as technical analysts converge on a $3.46-$3.48 price target, with the cryptocurrency currently trading at $3.27. A symmetrical triangle pattern suggests an impending breakout, with critical resistance at $3.3072 and support at $3.20.

Market sentiment remains cautiously optimistic, reflected by an RSI of 58.50 in neutral territory. Coin Edition's technical analysis aligns with AI-driven projections from Price Forecast Bot, both pinpointing the $3.46-$3.48 range as the next likely move.

The tight clustering of predictions indicates modest upside potential, though traders await a decisive breakout from the current range-bound activity. A failure to breach resistance could see a retest of support levels at $3.20 or even $2.73.

XRP Breaks Key Resistance After Ripple-SEC Win — Is $8 Next?

XRP extended its bullish momentum, climbing 3.10% from $3.24 to $3.33 amid heightened institutional activity. The breakout through $3.27 resistance on triple-average volume signaled strong accumulation, with overnight sessions reinforcing upward pressure. Support solidified at $3.20-$3.22 while profit-taking emerged near session highs.

The resolution of Ripple's legal battle with the SEC has removed a major overhang, drawing comparisons to XRP's 2017 breakout. Market structure shifts suggest growing institutional participation, with analysts eyeing $6-$8 targets if momentum sustains. Liquidity absorption patterns indicate this rally may have staying power unlike previous speculative spikes.

New XRP Data Reveals Wealth Thresholds for Top Holders Amid Price Surge

XRP's recent price rally has created a paradoxical shift in wealth distribution metrics. The token count required to enter the top 10% of holders dropped slightly to 2,433 XRP, while the dollar equivalent surged 29% to $7,299 due to the asset's 32% monthly gain.

Entry into the elite 1% now demands 50,108 XRP - a position costing $150,000 today compared to $115,000 in early July. This $35,000 premium reflects XRP's climb above $3 after briefly touching $3.66 in late July.

Market analysts view this inverse relationship between token requirements and dollar costs as a bullish signal. The compression of supply among top wallets coincides with growing institutional interest in Ripple's ongoing legal clarity.

XRP Peaks at $3.33 on Heavy Volume Before Profit-Taking Reversal

XRP surged to a session high of $3.33 amid double-average trading volume, signaling institutional participation before a sharp pullback. The token gained 2.81% over 24 hours, oscillating between $3.20 and $3.29 with 3.89% volatility. A late-session rally to $3.32 on 11.30M volume was swiftly met with profit-taking, driving prices down to $3.26 on 14.00M volume.

Ripple's recent SEC settlement has removed regulatory uncertainty, though on-chain data shows limited new wallet growth despite price strength. The $3.33 level remains key resistance after capping advances, while $3.20 support held firm through the session's two-way action.

XRP Price Prediction: Critical Support at $3.27 Holds Key to Bullish Rally

XRP faces a pivotal moment as analyst Ali Martinez identifies $3.27 as the make-or-break support level. Holding this floor could propel the cryptocurrency toward $3.60, marking a potential 21% upside. Recent volatility has tested this threshold, with the asset currently consolidating near the critical zone.

Market sentiment hinges on technical factors—a decisive break above $3.29 may confirm bullish momentum. However, waning open interest in XRP futures, now at $7.9 billion, signals reduced speculative appetite. "The $3.27 boundary separates recovery from retracement," Martinez notes, suggesting failure to defend this level risks a slide toward $3.00.

XRP Shows Bullish Signals Indicating Potential Price Surge

XRP is displaying multiple bullish technical signals, suggesting a potential upward price movement. The cryptocurrency has maintained a steady climb, holding firmly above the $2.68 support level. Stable moving averages and an RSI below overbought territory indicate healthy momentum with room for further gains.

The price is currently trading between $3 and $3.40, approaching a critical resistance level at $3.65. A breakout above this level could propel XRP toward $4.12, marking a significant rise from current levels. Over the past month, XRP has gained over 16%, with a six-month increase of 29%, underscoring its strong growth potential.

Investor optimism remains high as market conditions favor further appreciation, provided support near $2.68 holds. The alignment of these factors suggests that XRP may be poised for its next bullish phase.

SEC Shifts Focus to Crypto Regulation Post-Ripple Case

The U.S. Securities and Exchange Commission is pivoting from litigation to rulemaking following the resolution of its high-profile case against Ripple Labs. Chair Paul Atkins emphasized the agency's renewed commitment to establishing clear regulatory frameworks for digital assets—a move Commissioner Hester Peirce hailed as necessary for balancing innovation with investor protection.

The conclusion of the five-year legal battle coincides with Congressional debates over the CLARITY Act, which remains stalled amid partisan divisions. Market participants now await concrete guidance that could shape the future of cryptocurrency trading and compliance.

XRP Breaks Key Resistance, Eyes $4 Amid Bullish Momentum

XRP surged past its 2018 all-time high of $3.40, reaching $3.65 on July 18 before consolidating near $3.20. Technical indicators suggest sustained bullish momentum, with the Relative Strength Index holding above 50 and strong support at $3. Market participants now anticipate a potential test of the $4 psychological barrier.

Savvy Mining emerges as a complementary opportunity for XRP holders, offering cloud-based mining contracts powered by renewable energy. The platform promises daily passive income denominated in XRP, decoupled from price volatility. Its AI-driven infrastructure claims to eliminate hardware maintenance while ensuring transparent profit distribution.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Bullish | Catalysts |

|---|---|---|---|

| 2025 | $3.48 | $7.14 | XRPL upgrades, Ripple-SEC clarity |

| 2030 | $12 | $25 | CBDC adoption, cross-border dominance |

| 2035 | $30 | $60 | Enterprise blockchain scaling |

| 2040 | $75 | $150+ | Tokenized economy integration |

Ava projects a 1,200%+ growth by 2040, assuming XRP captures 10% of global payment flows. Near-term, the symmetrical triangle breakout points to $3.46-$3.48.